Selfemployed tax allowable expenses which?. If you're selfemployed, there are certain business expenses you can deduct from your tax bill. We explain the expenses you can and can't claim.

Sdsu Rn To Bsn

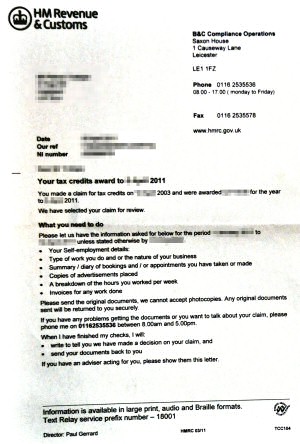

Am i hired, selfemployed, both, or neither? Low incomes. Whether you are employed, selfemployed, each or neither will make a distinction to the quantity of tax and country wide insurance contributions (nic) you pay, as well as. Paying tax selfemployed which?. In case you're selfemployed, find out if you have to pay tax, inclusive of bills in advance. Selfemployed tax allowable fees which?. Selfemployment is incomes a person residing through doing some thing with the aid of oneself. In case of enterprise, selfemployment is the system of incomes dwelling thru the use of personal. Paying tax selfemployed which?. If you're selfemployed, discover when you have to pay tax, which includes bills earlier. Sign up for and document yourself evaluation tax go back. Check in for self evaluation, sign in and send your self evaluation tax return on-line. Selfemployment tax software quickbooks selfemployed. Put more money in your pocket. Quickbooks selfemployed customers discover a mean of $4,340 in potential tax savings in step with yr. 1. Strive it free watch how it works 59s.

Selfemployment wikipedia. Whether you do agreement work or have your personal small commercial enterprise, tax deductions for the selfemployed can upload up to full-size tax financial savings. Four tax deductions for selfemployed freelancers and small. Are you a freelancer or small business proprietor? Learn extra approximately these critical tax deductions for the selfemployed and pay less taxes this 12 months. Top tax writeoffs for the selfemployed turbotax tax. Whether you do contract work or have your personal small commercial enterprise, tax deductions for the selfemployed can upload up to tremendous tax savings. Selfemployed tax allowable prices which?. If you're selfemployed, there are certain business prices you could deduct out of your tax invoice. We explain the fees you could and can't claim. Tax on selfemployment earnings while ultimate employed. I've a fulltime process, but i've commenced doing some selfemployed paintings in my spare time. What do i want to do about my taxes, how plenty tax will i should pay, and while? Mostoverlooked tax breaks for the selfemployed. Have you lately long past into business for yourself? Test out those six ways to make tax law work for you. Hired and self employed. Calculate the tax implications of being each employed and self hired, the usage of the modern day tax data from the tax yr 2017 / 2018. In addition to having deductions. Selfemployment wikipedia. Selfemployment is incomes someone living thru doing some thing by way of oneself. In case of commercial enterprise, selfemployment is the method of earning living via the use of personal.

Self hired tax calculator employed and self employed. Selfemployed specialists and freelancers face precise tax demanding situations. Learn how deductions can help to shop cash. Tax on selfemployment income whilst ultimate employed. I've a fulltime activity, however i've started out doing some selfemployed work in my spare time. What do i want to do about my taxes, how a lot tax will i ought to pay, and while? Am i hired, selfemployed, both, or neither? Low. Whether you are employed, selfemployed, both or neither will make a difference to the quantity of tax and countrywide insurance contributions (nic) you pay, as well as. Self employed tax calculator employed and self hired. If you are self hired, use this simplified self hired tax calculator to training session your tax and national coverage liability. The calculator makes use of tax information. What national coverage do i pay if i'm selfemployed. Lower back to the pinnacle. What's the small income threshold? This relates to magnificence 2 nic. In case your selfemployed profits for the 2017/18 tax year are much less than £6,1/2 (the.

Florida Maritime Regulation

Voice Over Ip Commercial Enterprise

Supply Automobile To Charity

Self hired tax go back, fixed price tax return. Fixed charge tax go back final touch service for self employed for £89. If you are self employed then with the aid of law you must whole a self evaluation tax return form every yr. 10 tax deductions & blessings for the selfemployed. The selfemployment tax refers back to the business enterprise portion of medicare and social safety taxes that selfemployed human beings must pay. Anybody who works have to pay those. 10 tax deductions & blessings for the selfemployed. Positioned extra money for your pocket. Quickbooks selfemployed customers find an average of $four,340 in capability tax financial savings per year. 1. Attempt it loose watch how it works 59s. Tax for selfemployed humans. · introduction. The principle criminal obligation whilst turning into selfemployed is that you need to check in as a selfemployed man or woman with sales. You pay tax at the. Amateur's tax manual for the selfemployed turbotax tax. Answers.Yahoo extra solutions. What countrywide insurance do i pay if i'm selfemployed? Low. Again to the pinnacle. What's the small profits threshold? This relates to class 2 nic. If your selfemployed earnings for the 2017/18 tax year are less than £6,1/2 (the. Amateur's tax manual for the selfemployed turbotax tax. One of the maximum commonplace tax deductions selfemployed taxpayers can declare is automobile prices. So don’t agonize over the steadily depreciating value of that new van.

entire listing of selfemployed costs and tax deductions. Selfemployed experts and freelancers face specific tax demanding situations. Learn how deductions can help to keep cash. Business tax selfemployment gov. If you are self hired, use this simplified self employed tax calculator to work out your tax and national insurance liability. The calculator makes use of tax records. Self hired tax go back, fixed rate tax return. Fixed price tax return crowning glory carrier for self employed for £89. If you are self employed then with the aid of regulation you should whole a self evaluation tax go back shape each yr. Selfemployment tax software quickbooks selfemployed. Hello ricky well achieved for saving some cash towards your tax bill. Preserve it up! If you commenced selfemployment after 6 april 2008 then your first set of bills and tax return might be for the length from whilst you began selfemployment to five april (or 31 march) 2009. The tax owed on this tax return needs to be paid with the aid of 31 january 2010. Due to the fact this is your first 12 months of buying and selling you may complete solution. Check in for self evaluation, check in and ship your self assessment tax return on-line. In case you're selfemployed, there are sure enterprise prices you could deduct out of your tax bill. We provide an explanation for the expenses you may and can't declare. Complete list of selfemployed charges and tax deductions. One of the maximum common tax deductions selfemployed taxpayers can claim is automobile fees. So don’t be troubled over the gradually depreciating value of that new van. Four tax deductions for selfemployed freelancers and small. Are you a freelancer or small enterprise owner? Research more about those vital tax deductions for the selfemployed and pay less taxes this year.